Death and taxes: they are the so-called certainties in life. But like so many things in our increasingly unequal world, money can buy you a better deal on both. Well not just money, specifically loads and loads of money. Being mega wealthy can apparently procure you an extra 31 healthy years. And as for tax, Inland Revenue and Treasury recently reported that the wealthiest kiwis (net worth of $50 million or more) are paying just 9.4% tax to the average New Zealander’s 20.2%.

Given the amazing bargain they’re getting, it’s more than a bit galling that, as part of the recent budget, Chris Hipkins has ruled out a wealth or capital gains tax to help us shoulder the cost of our climate crisis, including the devastating impacts of Cyclone Gabrielle.

Ironically it is an unfortunate but clear fact that with wealth comes a big carbon footprint… and with even greater wealth comes an even greater carbon footprint. The richest 1% of the world (those earning more than $172,000 USD a year) produce 15% of the world’s carbon emissions: twice the combined impact of the poorest 50%. NZ has a whopping 14 billionaires, each of whom are likely responsible for producing an average of over 8,000 tonnes of carbon dioxide (3,500 times their fair share in a world committed to no more than 1.5C of heating).

Quote: “Over the past 25 years, the richest 10% of the global population has been responsible for more than half of all carbon emissions... Rank injustice and inequality on this scale is a cancer. If we don’t act now, this century may be our last.”

Antonio Guterres, UN Secretary General

So to sum up, with the current tax plan, our super wealthy are contributing less than the average Joe to mitigation, adaptation and recovery from climate change events. This is despite the fact that they are personally doing the most to cause climate breakdown.

So how could a wealth tax help?

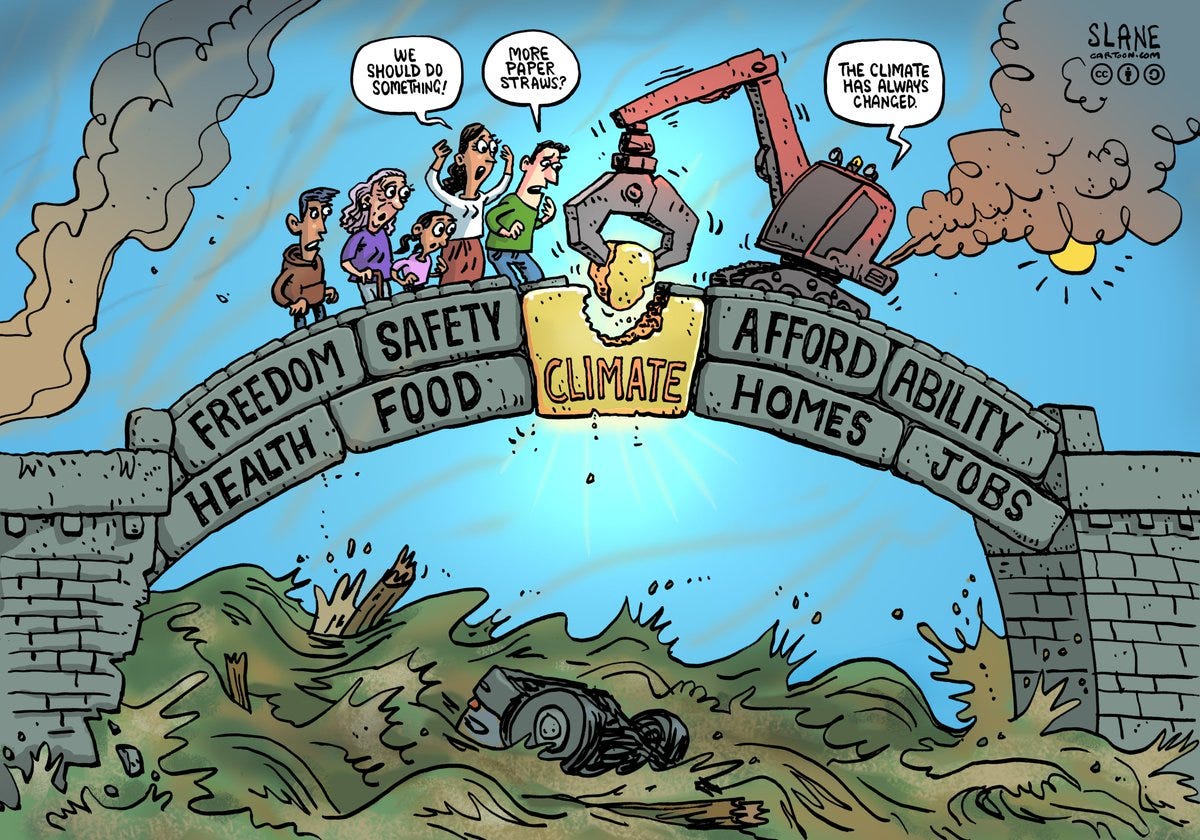

Moving to a carbon zero system will be expensive, but much less expensive than the certain costs of climate change. If we don’t acknowledge the fact that the impacts of climate change will be harder on the poor than the rich, it could create even bigger wealth inequalities. Low-income households could end up taking on the financial burdens of climate change mitigation (e.g. being forced to buy an EV because there are no other transport options) and adaptation (e.g. paying for repairs on their flood-prone house) alongside transitional issues like job losses and increased costs of goods.

Net zero might sound expensive, but it’s also affordable - for our billionaires with a lot of cash to spare. To give you an idea just how much, check out this visual of what wealth looks like in pixels – hint it’s way way way bigger than you’d think.

A wealth tax is basically an as-yet-untapped source of government revenue that could provide most if not all the funds for a just transition to a low/zero carbon country, all without burdening 94% of kiwis (basically anyone with less than $1 million). As for the ultra-rich who we would be taxing, it would be a drop in the bucket - a far cry from the very real hardship that many New Zealanders feel when hit with both a climate and cost of living crisis.

Taxes are also a powerful mechanism for ensuring that the rich pay their fair share - since it’s been well proven that the rich have emitted the vast majority of the world’s emissions. There are other options of course, like banning private jets or using market measures like tradable energy quotas. There are other options of course, like tradable energy quotas (personal carbon footprint trading) or banning private jets. But taxing the ultra-rich also has the benefit of generating revenue for initiatives that help us overcome the challenges of climate change (flood relief, subsidising groceries when food prices go up due to extreme weather, creating more bike lanes, subsidising e-bikes as we shift away from fossil fuel vehicles).

Labour may have ruled out transformative tax changes in this year’s Budget, but a fairer tax system is still up for debate for the coming election. As we get closer to this climate election we should consider wealth tax as a major tool to achieving a fairer, low carbon future.

Want to chip in for a fairer tax system? Support Tax Justice Aotearoa’s crowdfunding campaign for fairer taxes this election.

The Budget on 15 May will still be one to watch for how spending is allocated.

It might come as a surprise, but as a currency-issuing government the taxes the NZ Gvt receives are not recycled to 'pay for' its spending, instead they are simply removed from the economic system (deleted). Here's a short-animated video explainer. (Btw I just joined your newsletter and submitted response to your short Q&A, feel free to reach out to learn more).

https://youtu.be/fg0R9Ye2ovM?si=6jVRUezdy5Vx3xLm